In this second part of our series on buying direct marketing data primarily on price, we look at the quantifiable costs and returns.

We work through an example campaign using good data, and then consider the outcomes if we use cheaper data. There look like quite a lot of numbers here, but bear with it, it should all make sense.Example Campaign Objective:Here is an example of a fairly normal B2B customer generation campaign for an

SME.

• Find 25 new B2B customers

• First Order Value £450 (Total value £11,250)

• Lifetime Value £700 (Total value £17,500)

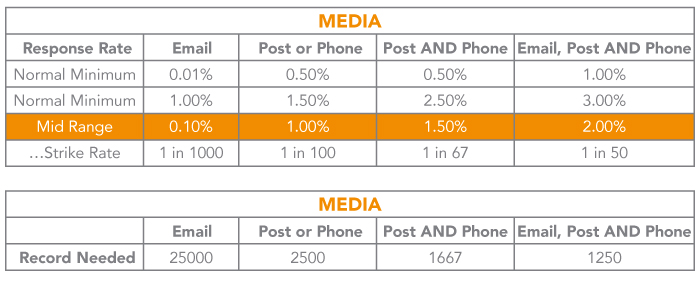

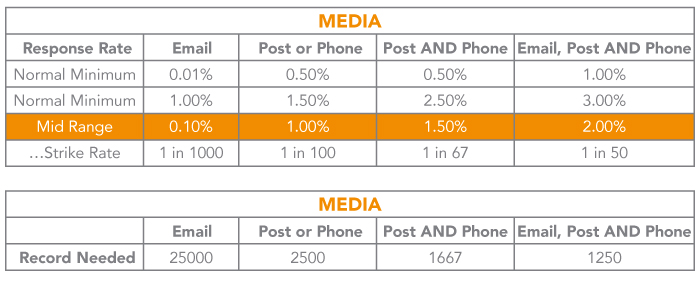

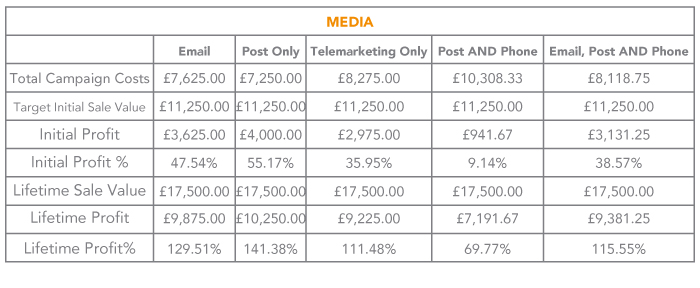

Media Options:It may be obvious, but response rates do make a considerable difference to the eventual success of a campaign and vary greatly.

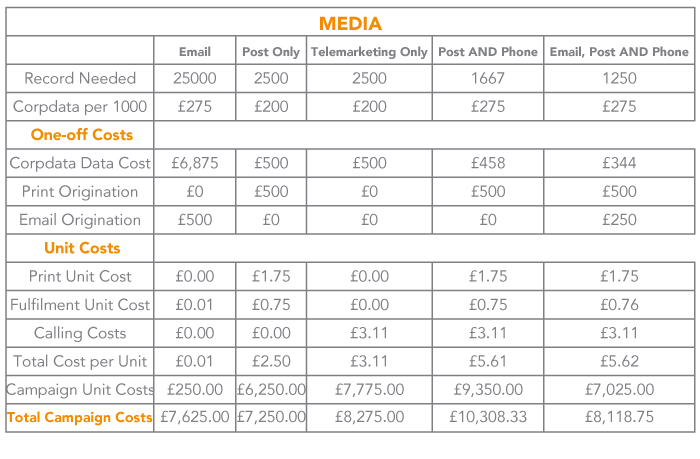

Working with the mid range response rate, the following data is required in order to hit the target of 25 new customers:

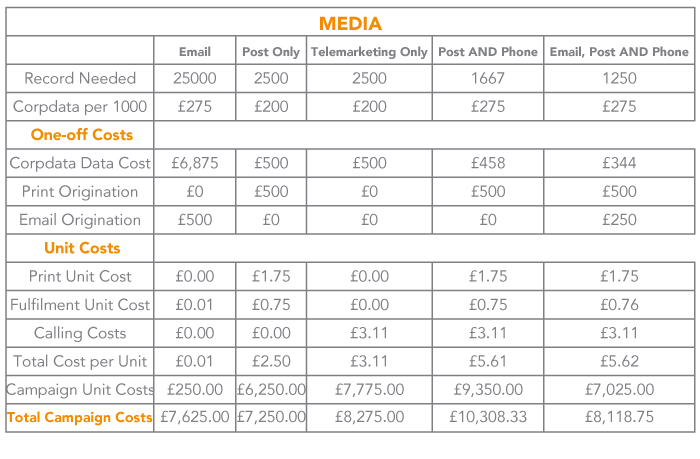

Initial design for an email or a mailer are normally quite similar. In today's market the average fee for a standard mailer would be in the region of £500. Origination of the other form of media (i.e. email if a mailer has already been produced) will be approximately 50% of the cost of the first piece.

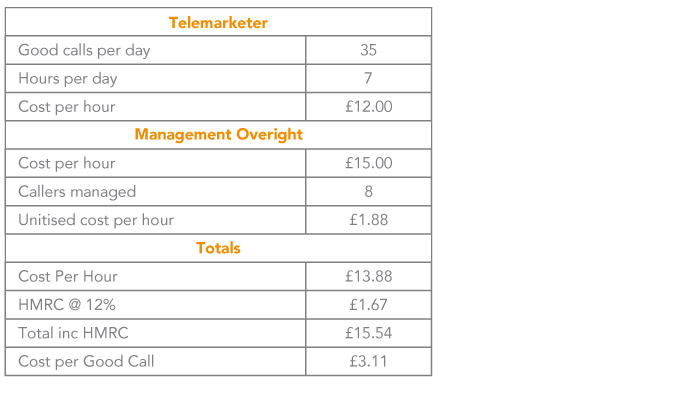

Costs analysis:  Calling cost breakdown

Calling cost breakdown Email

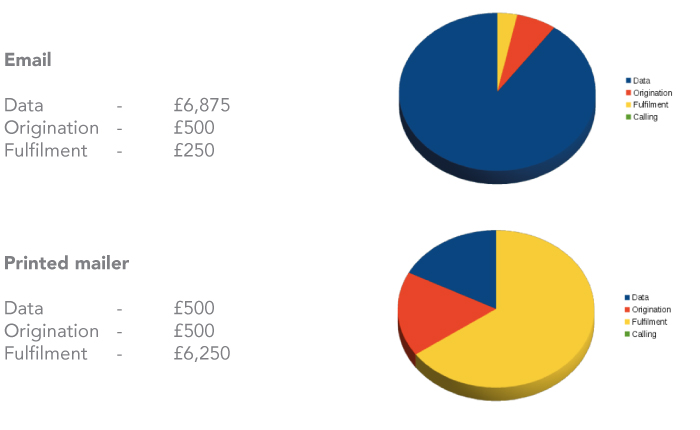

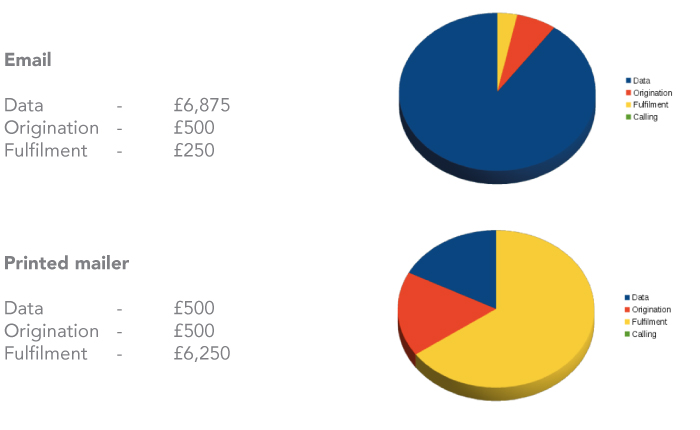

Email - Generally speaking people are less likely to make large purchasing decisions just on the strength of an email. In fact using email as the original introduction of a product can actively weaken the perception of the brand. However, email is ideally suited to standardised commodity products, especially when promoted to a tech savvy audience.

Typically emails are delivered very quickly.This means on the occasions when emails are sent with copy errors, which can happen, everyone will receive 'flawed' copy with little time to recover. Email address deliver-ability changes rapidly, and ever more sophisticated spam suppression software can reduce the actual deliverable rate below expectations.

In addition, email represents a very congested marketing space; using email means competing with many other organisations, including very large brands and household names. Our experience indicates that any buying rates higher than 0.1% from email are rare, representing an upper-end return. Also, legislation is more restrictive in the email domain. Without delving into too many technicalities, not everyone can be sent email, and the soon-to-become-binding GDPR is set to tighten up this area still further. (If you wish to know more, please contact Corpdata on 01626 777400)

Campaign costs %

Printed mailer - In recent years, the expense of mailer print and fulfilment has led to a decline in it's use, consequently this marketing space is less congested than others. The tangible nature of the mailer attaches value to the proposition in the recipient's eyes. Surveys and studies from many countries and organisations, such as (*) suggest ROI is much the same from both email and postal campaigns. This would suggest when it comes down to results, the higher initial cost can be offset by response rates. Our example also seems to suggest a similar result. (*

https://www.onlinemarketinginstitute.org/blog/2013/06/why-direct-mail-still-yields-the-lowest-cost-per-lead-and-highest-conversion-rate/)

Similar to email, errors are difficult to correct once the campaign has been launched, although, it is possible to deliver the mail in smaller units.

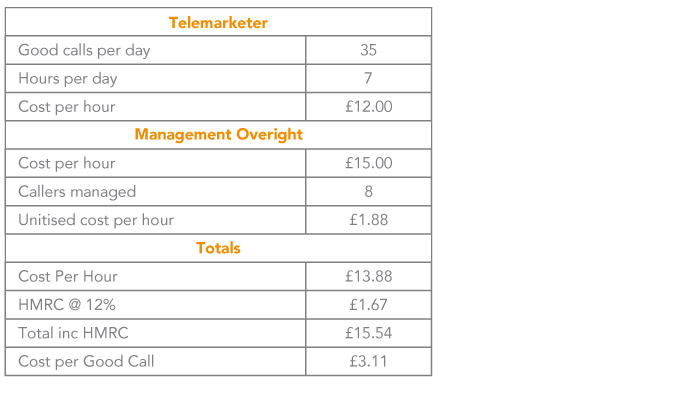

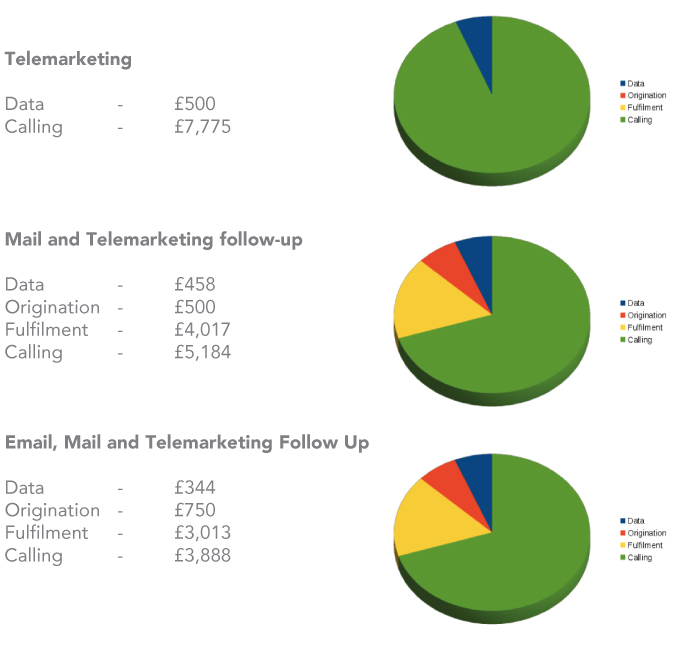

Telemarketing - The initial outlay for a telemarketing campaign is low. The real costs are masked in man-hours in terms of both of telemarketers and management oversight. If you have spare resources, this can be a fantastic way to create new business. The high cost of this medium highlights the importance of good quality data.

Campaign costs %

For an integrated campaign, telemarketing with a mail follow-up, it is beneficial to send mail just before the follow-up call. It is advisable to manage opt-outs. Although not legally binding it is wasteful to contact people who don't want to hear from you. Although not yet clarified this also may change with the GDPR.

If you are telephoning or emailing, opt-out's must be respected, and you must manage your own opt-out lists together with the TPS and CTPS lists. These schemes allow consumers (TPS) and businesses (CTPS) to place their numbers on a central suppression register which marketers are legally obliged to check against when making calls. There is a 28 day grace period for changes in numbers. Recently the ICO has been more active in policing telephone marketing abusers, the fines can be high. Here at Corpdata we help our customers manage their TPSand CTPS compliance. (Please contact Corpdata if you need to find out more, 01626 777400)

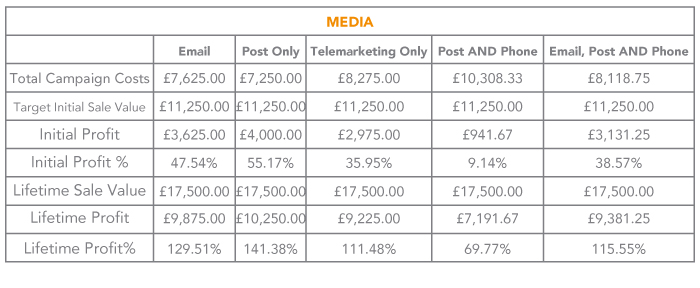

Return on Investment analysis:

This example campaign shows that all the methods make commercial sense, however some are clearly better than others. Making the decision on which media to use is perhaps not as clear as one might imagine.

As we have mentioned already, the data is key, not least when we start to look at the possible risks of direct marketing campaigns.Direct marketing isn't a panacea, but it can be a very useful business tool.

It's all about the dataFrom this hypothetical example in most cases the other costs of the campaign are more significant than the data costs.This is hidden in email campaigns, but as we will see, tends to play in the results.

UK B2B Data Facts

Given the volume of each of these changes, making sure data is up to date is a major issue. Here at Corpdata we believe that a research cycle of 6 months is suitable for ensuring a minimal gone-away rate. This frequency of research is time-consuming and costly, and these costs must inevitably be passed on to the users of the data. The reality is 'you get what you pay for'.

Some argue that data can be prepared once and sold many times, thus reducing the cost. Of course we already do this. When providing bespoke projects, a cost in excess of £10 to research each record is not unusual. All reputable UK B2B data providers who research their data and manage goneaways charge similar rates. It is the cost of doing the job properly.

Others claim their data is 'updated by telemarketing companies as they make their calls'. The reality here is that a telemarketing agency will simply supply call records showing which lines were dead and which connected. No insights into the organisations or information about the decision makers!

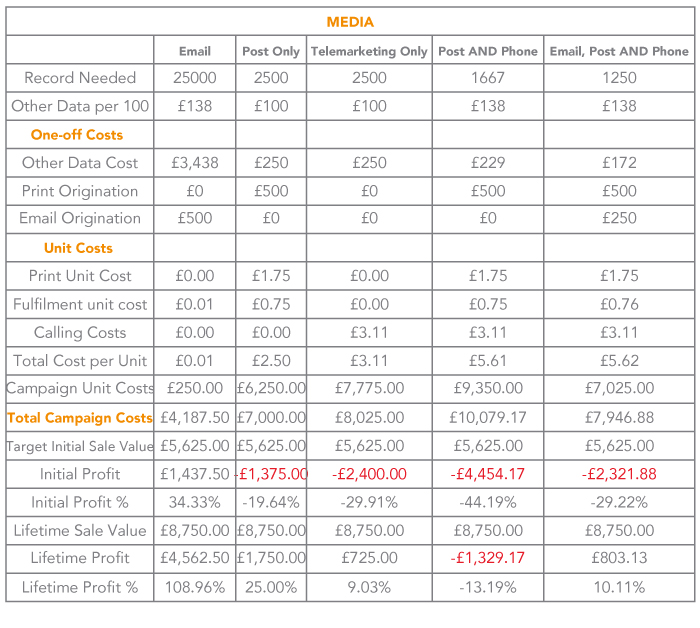

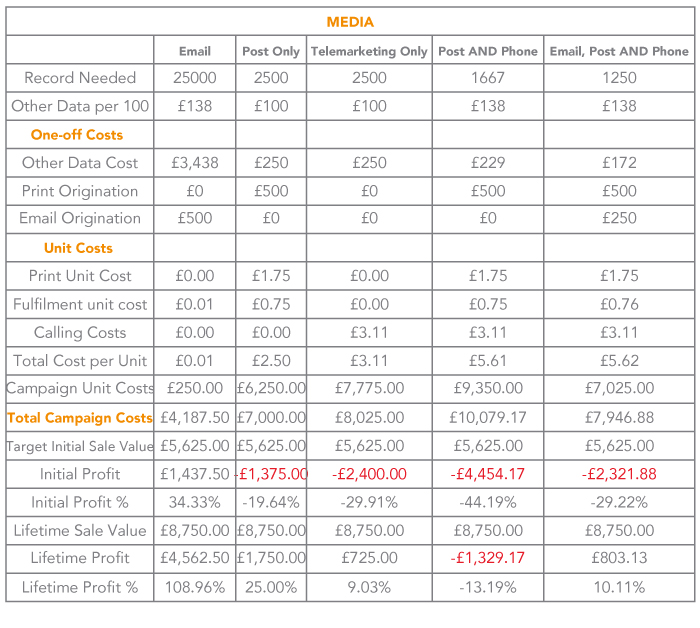

The quantifiable costs of using data purchased on price.The real world is much less linear than straight forward data comparison. Taking our earlier example, we now extend it by looking at the outcomes when data, 50% cheaper than Corpdata is used delivering 50% of the result.

Cost analysis when cheaper data is used:

At a quick glance in this crude sensitivity test, email results are seen as the least affected, whereas a fully integrated campaign is now pushed into negative ROI.

But this isn't all! The campaign hasn't delivered it's results, so whilst the ROI might still look OK, the painful news is the company needs to make savings somewhere

else!

As we can now see, when it comes to direct marketing, data is not only necessary,but is a 'force-multiplier'. These figures are clearly only indicative, but they are by no means unusual. Please feel free to substitute your own, your mileage may vary.

In conclusion, you may feel inclined to think email is now a no-brainer in a risk sense. We would urge you not to be so hasty. Next month we will be looking in detail at some of the less easily quantifiable costs and risks of using direct marketing data purchased primarily on price.

Initial design for an email or a mailer are normally quite similar. In today's market the average fee for a standard mailer would be in the region of £500. Origination of the other form of media (i.e. email if a mailer has already been produced) will be approximately 50% of the cost of the first piece.

Initial design for an email or a mailer are normally quite similar. In today's market the average fee for a standard mailer would be in the region of £500. Origination of the other form of media (i.e. email if a mailer has already been produced) will be approximately 50% of the cost of the first piece. Calling cost breakdown

Calling cost breakdown Email - Generally speaking people are less likely to make large purchasing decisions just on the strength of an email. In fact using email as the original introduction of a product can actively weaken the perception of the brand. However, email is ideally suited to standardised commodity products, especially when promoted to a tech savvy audience.

Email - Generally speaking people are less likely to make large purchasing decisions just on the strength of an email. In fact using email as the original introduction of a product can actively weaken the perception of the brand. However, email is ideally suited to standardised commodity products, especially when promoted to a tech savvy audience. Printed mailer - In recent years, the expense of mailer print and fulfilment has led to a decline in it's use, consequently this marketing space is less congested than others. The tangible nature of the mailer attaches value to the proposition in the recipient's eyes. Surveys and studies from many countries and organisations, such as (*) suggest ROI is much the same from both email and postal campaigns. This would suggest when it comes down to results, the higher initial cost can be offset by response rates. Our example also seems to suggest a similar result. (*

Printed mailer - In recent years, the expense of mailer print and fulfilment has led to a decline in it's use, consequently this marketing space is less congested than others. The tangible nature of the mailer attaches value to the proposition in the recipient's eyes. Surveys and studies from many countries and organisations, such as (*) suggest ROI is much the same from both email and postal campaigns. This would suggest when it comes down to results, the higher initial cost can be offset by response rates. Our example also seems to suggest a similar result. (*  For an integrated campaign, telemarketing with a mail follow-up, it is beneficial to send mail just before the follow-up call. It is advisable to manage opt-outs. Although not legally binding it is wasteful to contact people who don't want to hear from you. Although not yet clarified this also may change with the GDPR.

For an integrated campaign, telemarketing with a mail follow-up, it is beneficial to send mail just before the follow-up call. It is advisable to manage opt-outs. Although not legally binding it is wasteful to contact people who don't want to hear from you. Although not yet clarified this also may change with the GDPR. This example campaign shows that all the methods make commercial sense, however some are clearly better than others. Making the decision on which media to use is perhaps not as clear as one might imagine.

This example campaign shows that all the methods make commercial sense, however some are clearly better than others. Making the decision on which media to use is perhaps not as clear as one might imagine. Given the volume of each of these changes, making sure data is up to date is a major issue. Here at Corpdata we believe that a research cycle of 6 months is suitable for ensuring a minimal gone-away rate. This frequency of research is time-consuming and costly, and these costs must inevitably be passed on to the users of the data. The reality is 'you get what you pay for'.

Given the volume of each of these changes, making sure data is up to date is a major issue. Here at Corpdata we believe that a research cycle of 6 months is suitable for ensuring a minimal gone-away rate. This frequency of research is time-consuming and costly, and these costs must inevitably be passed on to the users of the data. The reality is 'you get what you pay for'. At a quick glance in this crude sensitivity test, email results are seen as the least affected, whereas a fully integrated campaign is now pushed into negative ROI.

At a quick glance in this crude sensitivity test, email results are seen as the least affected, whereas a fully integrated campaign is now pushed into negative ROI.